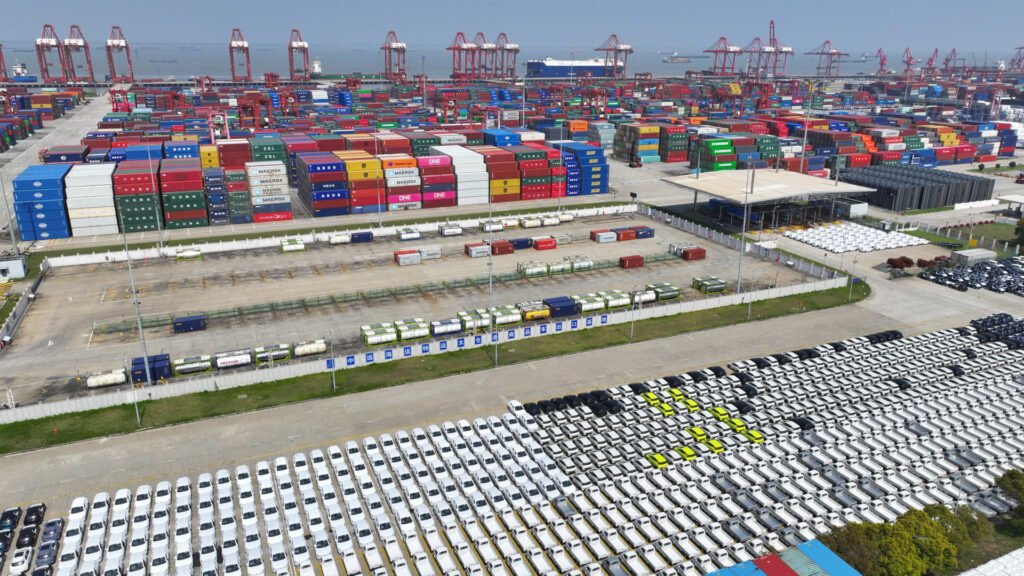

A batch of cars ready for shipment to overseas markets at Taicang Port, Jiangsu Province, China, April 9, 2024.

Future Publishing | Future Publishing | Getty Images

Asia-Pacific markets widened their decline as the world awaited Israel’s response to the weekend airstrike on Iran.

All eyes will be on Tuesday as China, the world’s second-largest economy, is expected to see its gross domestic product (GDP) grow 4.6% year-on-year in the first quarter.

China’s industrial production and retail sales figures will also be released on Tuesday.

Hong Kong’s Hang Seng Index futures were at 16,430, indicating a weak opening compared to HSI’s closing price of 16,600.

Japanese Nikkei Stock Average The stock price plunged 1.5% as a result of the move, and the comprehensive stock price index (Topix) fell 1.04%.

South Korea’s Kospi also fell by 1.31%, and the small-cap Kosdaq fell by only 0.86%.

In Australia, S&P/ASX 200 The stock fell 0.86%.

Stocks fell overnight in the U.S. on Monday as rising yields and concerns over Middle East conflict overshadowed Goldman Sachs’ strong profits and strong retail sales data.

of Dow Jones Industrial Average fell 0.65%, marking the sixth straight day of declines not seen since June.

of S&P500 The stock fell 1.2% after gaining as much as 0.88% earlier in the session.of Nasdaq Composite Technology stocks such as Salesforce fell, dropping 1.79%.

Rising interest rates also poured cold water on the market rebound, with the 10-year Treasury yield exceeding a key 4.6% level during trading, its highest level since mid-November.

—CNBC’s Hakyung Kim and Alex Harring contributed to this report.