Shenzhen KTC Technology Co., Ltd. (SZSE:001308) shareholders will have reason to smile today, as analysts have significantly revised upward their statutory forecasts for this year. This year’s revenue forecasts have been revised, and analysts are more optimistic about the sales pipeline. The stock has risen 5.7% over the past week to C$27.75, suggesting investors are becoming more optimistic. However, it remains to be seen whether this upgrade is enough to lift the stock price.

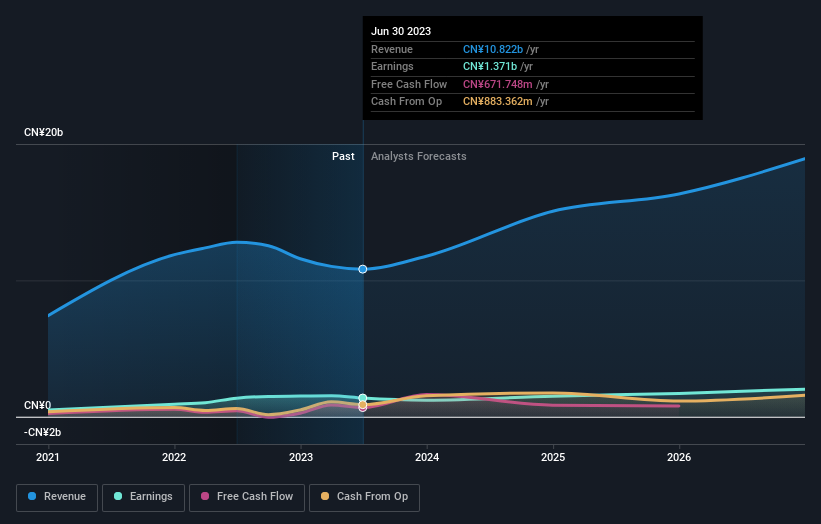

After the upgrade, the current consensus from Shenzhen KTC Technology’s five analysts is for 2024 sales of C$15 billion, which, if met, would represent 39% of sales over the past 12 months. This will reflect a significant increase. Statutory earnings per share are estimated to increase by 10% to CN 2.20. Before this latest update, analysts had been forecasting sales of CA$13b and earnings per share (EPS) of CA$2.11 in 2024. Sentiment certainly seems to have improved over the last few years, with strong sales growth and a modest rise in sales. Forecast of earnings per share.

Check out our latest analysis for Shenzhen KTC Technology.

With these upgrades in mind, it may come as no surprise to learn that analysts have increased their price target for Shenzhen KTC Technology by 13% to CA$31.75.

While these estimates are interesting, it can be useful to paint a broader stroke when comparing Shenzhen KTC Technology’s past performance and forecasts both to its peers. One thing that stands out about these estimates is that Shenzhen KTC Technology is projected to grow faster than ever in the coming years, with revenue expected to show 39% annual growth by the end of 2024. That’s it. Once achieved, this will look like this: That’s much better than the 15% annual decline over the past year. Comparing this to analyst forecasts for the industry as a whole, industry revenue is expected to increase (in aggregate) by 18% per year. Analysts say that not only are Shenzhen KTC Technology’s earnings expected to improve, but they also expect it to grow faster than the broader industry.

conclusion

The most important takeaway from this hike is that analysts have raised their earnings per share forecasts for this year in hopes of improving business conditions. They have also revised up their earnings forecast for this year, with sales expected to grow faster than the broader market. The price target has also been significantly increased, and analysts clearly feel that the intrinsic value of the business has improved. Seeing as this year’s forecasts have been revised significantly upwards, it may be time to take another look at Shenzhen KTC Technology.

Still, the long-term prospects of a business are far more important than next year’s earnings. We have multiple analyst forecasts for Shenzhen KTC Technology out to 2026, and you can see them for free on our platform here.

Of course, when looking at company management, invest a large amount of money Stock trends are just as useful as knowing whether analysts are revising their forecasts upward.So you can also search for this free A list of stocks that insiders are buying.

Valuation is complex, but we help make it simple.

Please check it out Shenzhen KTC Technology Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.