The most you can lose on any stock is 100% of your capital (assuming you don’t use leverage). However, if you choose a company that is truly prosperous, make over 100. for example, New Oriental Educational Technology Group Co., Ltd. (NYSE:EDU) stock has soared 140% over the past year. Most people will be very happy with this, especially if it is only for a year or less. It’s also good to see the stock price up 15% quarter-over-quarter. However, this move may have been driven by moderate market activity (up 8.5% in 90 days). On the other hand, long-term shareholders’ management has become even more difficult, and the stock price has fallen 40% in three years.

It’s been a good week for New Oriental Education & Technology Group shareholders, so let’s take a look at the long-term fundamental trend.

Check out our latest analysis for New Oriental Education & Technology Group.

in his essay Graham & Doddsville SuperInvestors Warren Buffett has said that stock prices do not always rationally reflect the value of a company. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

New Oriental Education & Technology Group went from a loss to a profit last year.

If a company has just moved into profitability, earnings per share growth isn’t necessarily the best way to watch its share price move.

However, the 42% year-over-year revenue growth should help. We do see some companies suppressing earnings in order to accelerate revenue growth.

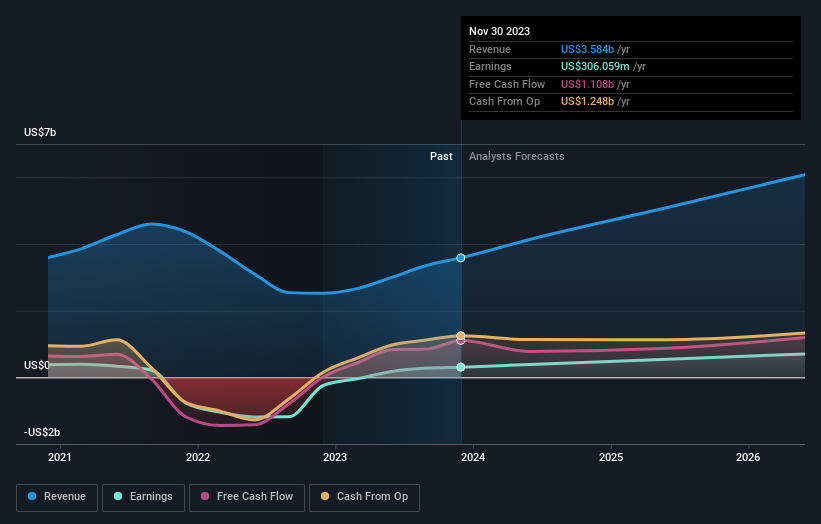

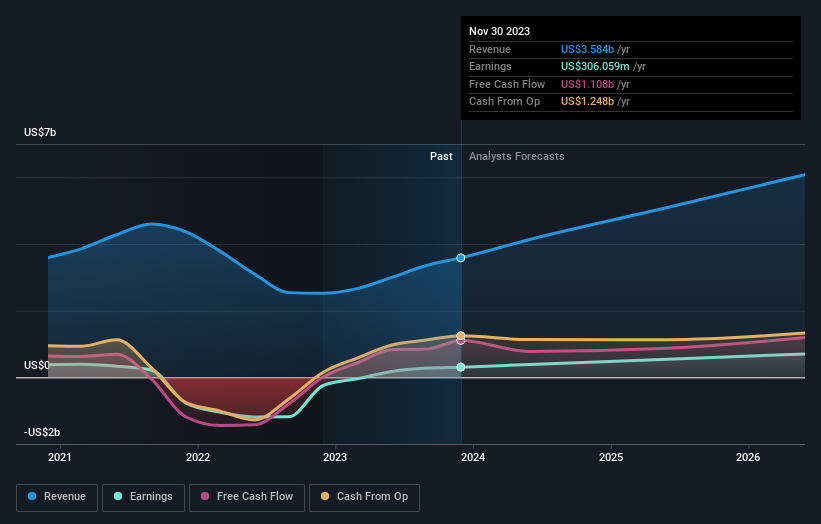

The image below shows how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

New Oriental Education & Technology Group is a well-known stock with many analysts covering it, suggesting some future growth is visible.Given that there are quite a few analyst forecasts, it might be well worth checking this out free Graph showing consensus estimates.

different perspective

We’re pleased to report that New Oriental Education & Technology Group shareholders have received a total shareholder return of 140% over one year. There’s no doubt that these recent returns are much better than the TSR loss of 0.2% per year over five years. While we typically value long-term performance over short-term performance, recent improvements may signal a (positive) inflection point within the business. See how New Oriental Education & Technology Group scores across these 3 metrics before deciding whether the current stock price is a good one.

of course New Oriental Education & Technology Group may not be the best stock to buy..So you might want to see this free A collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.