Ethena Labs, a decentralized protocol centered around the yield-generating USDe stablecoin, has been criticized by crypto traders in the weeks since making its token publicly available in February over similarities to the Terra ecosystem, which collapsed in 2021. caused polarization between the two.

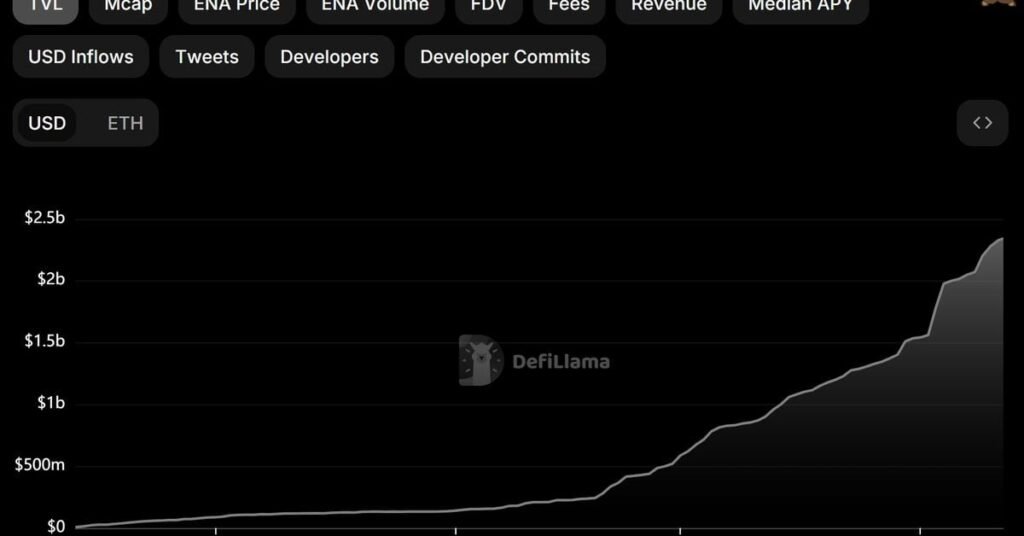

Those who stake USDe for at least 7 days currently earn an annualized yield of approximately 37%. This is high enough to push the protocol’s Total Value Locked (TVL) from his $178 million to his $2.3 billion, a 12x increase in just 60 days. . However, high yields are a double-edged sword and usually reflect high risk: Terra’s UST Paid close to 20% Become a staker before disappearing.

Unlike asset-backed stablecoins like Tether (USDT) and USDC, whose value is guaranteed against the dollar or a dollar equivalent such as U.S. government debt, USDe considers itself a synthetic stablecoin. The value of one dollar is maintained through a financial method known as cash-and-trade. -Carry trade. This transaction, which involves buying an asset and simultaneously shorting a derivative of the asset to recover the funding rate, or the difference between the two prices, is well known in traditional finance and is a directional There is no risk or delta risk involved.

“The trading itself is very safe and well understood, and many people (including Folkwang) have been doing this kind of trading for years.” Mike Van Rossum, founder of Folkvang, said: “But when we talk about delta, just remember that it is risk-free. There are a lot of things that can go wrong here. For example, if the exchange where these positions (and collateral) are managed If there’s a problem, etc.” Similarly, the problem with trying to execute hundreds of millions (or even billions) of dollars in a highly volatile market is similar. ”

Ethena users mint USDe tokens by depositing stablecoins such as USDT, dai (DAI), and USDC into the protocol. They can then stake minted USDe, which has a market capitalization of $21.3 billion, in exchange for yield.

To generate this yield, Ethena has deployed several strategies centered around cash-and-carry transactions.

Permanent interest rates on Bitcoin (BTC) and Ethereum (ETH) are currently positive, meaning long positions pay short positions and generate returns for those shorting the market. Typically, when the market is down, funding rates turn negative. This means that Etena’s revenue stream could dry up if the cryptocurrency enters a bearish cycle again.

The crypto whale appears unperturbed. According to , 10 wallets withdrew a total of $51 million of Ethena’s native governance token (ENA) from the exchange earlier this week and locked it in Ethena for a minimum of seven days. look on chain.

“The risk for Etena is not the collateral itself, but that the natural forces of the market could wipe out the yield or blow up the counterparty,” Jeff Dorman, Arca’s chief investment officer, said in an interview.

“What Athena is trying to do with basis trading is fairly simple and has been done in traditional markets for decades,” he said. “Anyone can do the same thing themselves with enough collateral and a trusted counterparty. What Ethena is doing is reducing the time it would take to do it yourself while increasing the risk. That’s all.”

Terra’s shocking death led to the bankruptcy of several other cryptocurrency companies and left a long-lasting scar across the industry. UST, an algorithmic stablecoin, exploded as it went into a death spiral following aggressive selling and a decline in the value of LUNA, which served as collateral.

“Comparing what Etena is doing to Luna is a very weak, surface-level argument,” Etena Labs founder Guy Young said in an interview with Laura Shinn on the Unchained podcast. Told. “The main difference here is to think about what backs a stable asset. So UST is backed by the LUNA token, which rose 100% in one week and fell 50%. Ethena’s USD is completely is backed by and fully collateralized.”

Regarding reliance on the bull market, Young said: “I think it’s a legitimate concern. What we’ve seen is evidence that if you were to bet on ETH in 2022, you could still have interest rates that are higher than U.S. Treasuries. “There is, but I’m imagining it.” We will see a reasonable easing of USDe supply in a bear market. ”

“This is fine with us,” Young said. “It’s just responding to market trends, and we’ll adjust to a smaller size as interest rates get lower and there’s less demand for longer leverage.”

Young did not rule out changing Athena’s yield generation strategy to one that “makes sense in a bear market” if necessary.