Norwegian data center market

DUBLIN, April 11, 2024 (Globe Newswire) — The “Norwegian Data Center Market – Investment Analysis and Growth Opportunities 2024-2029” report has been added. ResearchAndMarkets.com Recruitment.

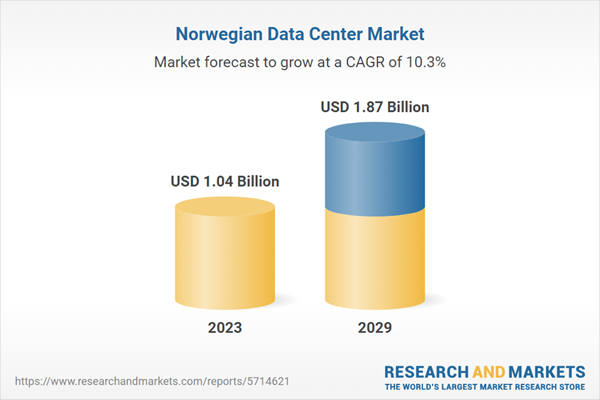

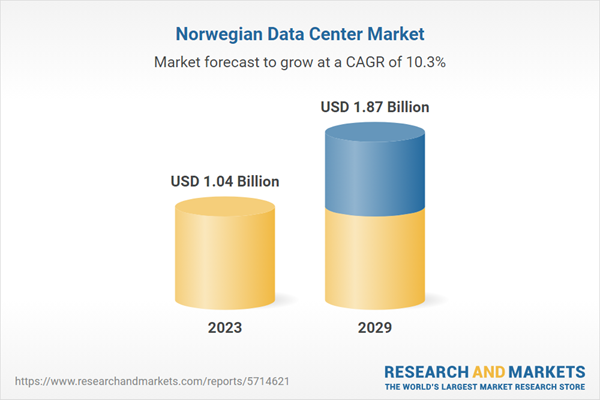

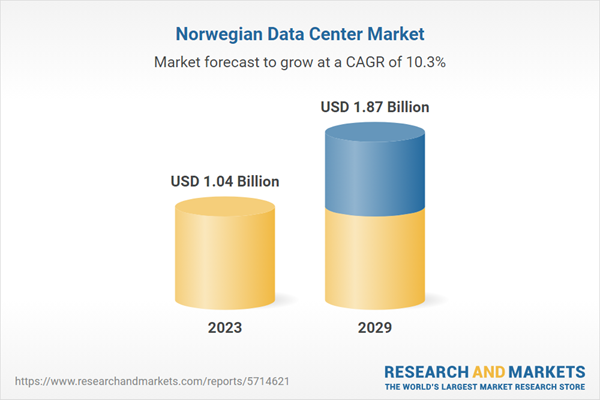

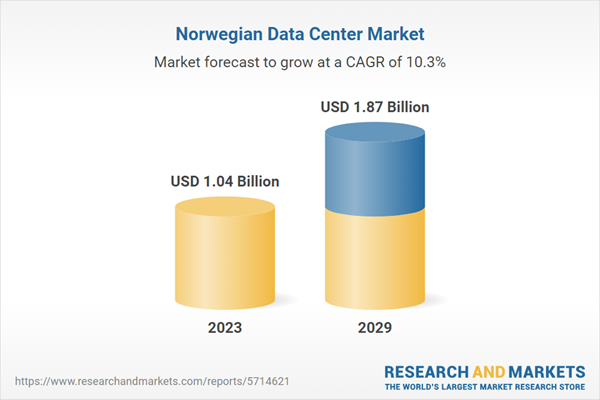

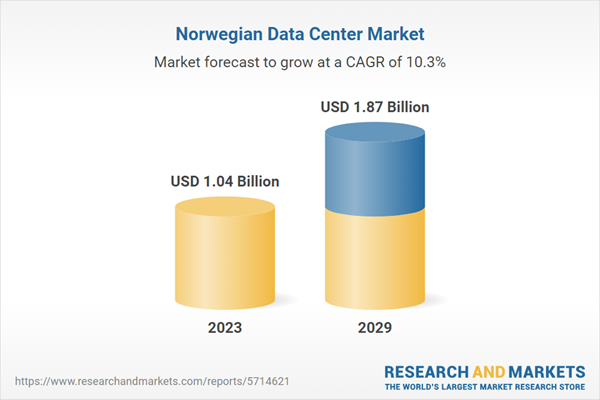

The Norwegian data center market was valued at USD 1.04 billion in 2023 and is projected to reach USD 1.87 billion by 2029, at a CAGR of 10.27%.

The Norwegian data center market is experiencing steady growth due to key factors. Government initiatives, tax incentives and a supportive regulatory framework, including the “Norwegian Data Centers – Sustainable Digital Power Centers” strategy, contribute to a favorable business environment.

The government is considering regulating data centers based on electronic communications rules to ensure digital security and protect national interests. We promote the use of Norway’s renewable energy benefits for sustainable growth of the industry. Norway’s industrial parks, such as Mø Industrial Park, Mønstad and Heroya Industrial Park, are central to new-age technology and sustainability initiatives, and are of vital importance in fostering innovation and promoting a circular economy.

Key customers in the Norwegian data center environment include cloud service providers and enterprises focused on high performance computing (HPC) applications.

Norway’s emphasis on harnessing waste heat for efficiency and environmental responsibility is in line with global trends in sustainability and is attracting environmentally conscious investors and companies. Masu. As of early 2023, Norway had 5.4 million internet users and 4.62 million active social media users. This strong digital implementation will contribute to the increase in data traffic, further driving the growth of the country’s data center market.

Key reporting features

-

Market size regarding investment, area, power capacity, and Norway Colocation Market revenue is available.

-

Evaluation of Norwegian data center investments by colocation and enterprise operators.

-

Investments in total area (square feet) and power capacity (MW) of the nation’s cities.

-

Detailed study of the existing Norway Data Center market status, detailed market analysis and insightful forecasts on the Data Center market size during the forecast period.

-

Snapshot of existing and upcoming third-party data center facilities in Norway

-

Target facilities (existing): 31 facilities

-

Facilities identified (to come): 12

-

Coverage: 12+ locations

-

Existing vs. future (area)

-

Existing and future (IT load capacity)

-

-

Norwegian data center colocation market

-

Market Revenue and Forecast (2023-2029)

-

Retail and wholesale colocation pricing

-

Investments in the Norwegian data center market are categorized into IT, power, cooling, and general construction services, and the size and forecast are presented.

-

Comprehensive analysis of the industry’s latest trends, growth rates, potential opportunities, growth constraints, and prospects.

-

Business overviews and product offerings of prominent IT infrastructure providers, construction contractors, support infrastructure providers, and investors active in the industry.

-

Transparent research methodology and analysis of industry demand and supply aspects.

Vendor scenery

IT infrastructure provider

Data center construction contractors and subcontractors

-

colomatic

-

Kawi

-

CTS Nordix

-

designer group

-

key source

-

Oralis AS

-

red engineering

-

YIT

supporting infrastructure provider

-

ABB

-

alfa laval

-

austin hughes

-

career

-

caterpillar

-

COMSYS

-

cummins

-

DEIF

-

Eaton

-

fract group

-

HITEC power protection

-

Kohler SDMO

-

Legrand

-

perkins engine

-

pillar power system

-

Rittal

-

rolls royce

-

schneider electric

-

socomec

-

Stulz

-

train

-

Vertive

data center investor

-

bulk infrastructure

-

green mountain

-

green edge computing

-

Refdal Mine Data Center

-

orange business service

-

stack infrastructure

-

store speed

-

AQ Computing

Existing vs. Future Data Center

This report analyzes the Norwegian data center market share. Detailed analysis of existing and upcoming equipment and investments in IT, electrical, mechanical infrastructure, general construction, and strata standards. Market size and investment estimates for various segments are discussed.

Answers to key questions

-

What is the growth rate of the Norwegian data center market?

-

How much is investment in the Norwegian data center market expected to increase?

-

How many data centers have been identified in Norway?

-

Who are the key investors in the Norwegian data center market?

-

What are the driving factors of the Norwegian data center market?

Key attributes:

|

report attributes |

detail |

|

number of pages |

111 |

|

Forecast period |

2023-2029 |

|

Estimated market value in 2023 (USD) |

1.04 billion dollars |

|

Projected market value to 2029 (USD) |

$1.87 billion |

|

compound annual growth rate |

10.2% |

|

Target area |

Norway |

Main topics covered:

1. Existing and upcoming third-party data centers in Norway

1.1. Past market scenario

1.2. 30+ unique data center properties

1.3. Data center IT load capacity

1.4. Data center white floor space

1.5. Existing and future data center capacity by city

1.6. Target cities

1.6.1. Oslo

1.6.2. Other cities

1.7. List of upcoming data center projects

2. Investment opportunities in Norway

2.1. Microeconomic and macroeconomic factors in Norway

2.2. Investment opportunities in Norway

2.3. Investment amount by area

2.4. Investment by power capacity

3. Norwegian data center colocation market

3.1. Data center demand across industries in Norway

3.2. Norwegian colocation services market

3.3. Retail and wholesale data center colocation

3.4. Colocation Pricing (Quarter Rack, Half Rack, Full Rack) and Add-ons

4. Market trends

4.1. Market drivers

4.2. Market trends

4.3. Market constraints

5. Market segmentation

5.1. IT Infrastructure: Market Size and Forecast

5.2. Power Infrastructure: Market Size and Forecast

5.3. Machinery Infrastructure: Market Size and Forecast

5.4. Breakdown of construction costs

5.5. General construction services: market size and forecast

6. Tier standard investment

6.1. Tier I and II

6.2. Tier III

6.3. Tier IV

7. Major market participants

7.1. IT Infrastructure Provider

7.2. Construction Contractors

7.3. Supporting Infrastructure Providers

7.4. Data Center Investor

For more information on this report, please visit https://www.researchandmarkets.com/r/9ybji3.

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source of international market research reports and market data. We provide the latest data on international and regional markets, key industries, top companies, new products and latest trends.

attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900