Transaction summary

April 8, 2024 Prem Watsa (Trade, Portfolio)’s company, Fairfax Financial Holdings, puts focus on its investment portfolio by reducing its stake in Crescent Capital BDC, Inc. (NASDAQ:CCAP) Made some adjustments. The transaction included 267,893 shares sold at a price of $17.09 per share, resulting in a change in the company’s holdings by -12.80%. This move had a -0.31% impact on the portfolio, with his CCAP shares in the company totaling 1,824,805 shares, currently accounting for his 2.13% of the portfolio and his 4.90% of the company’s publicly traded holdings.

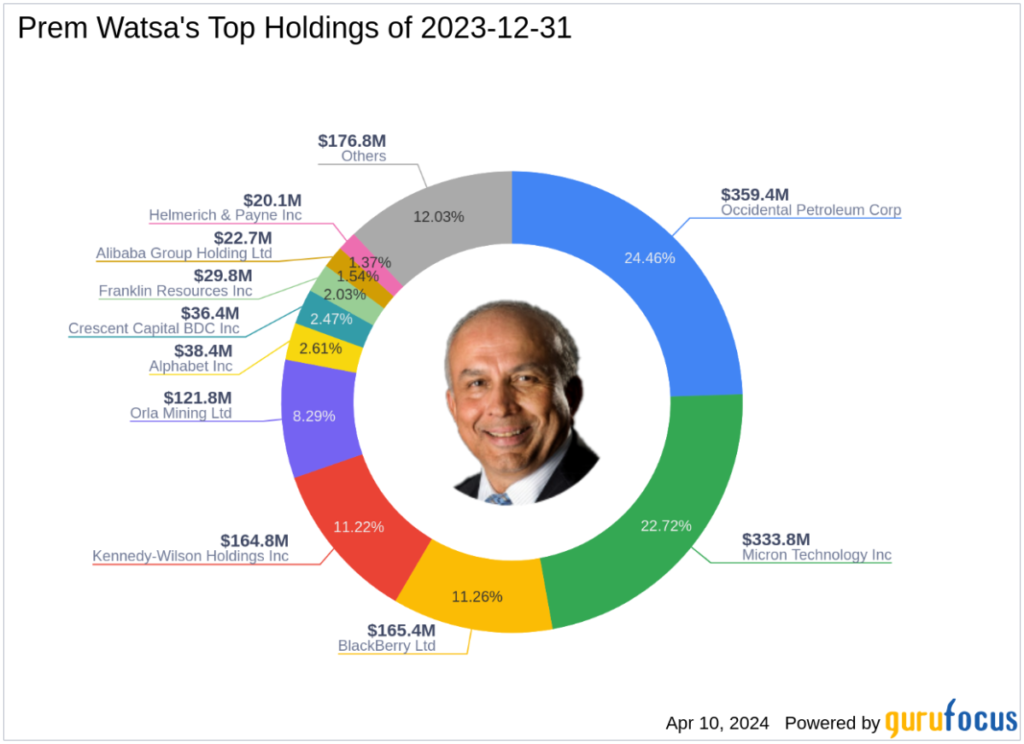

Prem Watsa Profile (Trading, Portfolio)

Prem Watsa (Trades, Portfolios), founder and leader of Fairfax Financial Holdings, is a well-known figure in the investment world. Born in India and brought to Canada with minimal funds, Watsa’s journey was a remarkable success. His investment philosophy is heavily influenced by Warren Buffett’s (Trade, Portfolio) strategy of using insurance float for value investing. Fairfax Financial’s approach is characterized by disciplined underwriting and a focus on long-term total returns, which has helped build shareholder value over the years. The firm’s major holdings include BlackBerry Ltd (NYSE:BB) and Micron Technology Inc (NASDAQ:MU), with a strong preference for the technology and energy sectors.

Company profile of Crescent Capital BDC Inc.

US-based Crescent Capital BDC Inc is a business development firm specializing in debt and related equity investments in US private middle market companies. Since his IPO on February 3, 2020, CCAP has focused on combining recurring income and capital growth to maximize the total return for shareholders. The company’s investment strategy combines secured and unsecured debt and equity with the aim of generating sustainable returns for investors.

Trade impact analysis

Recent transactions by the firm of Prem Watsa (Trading, Portfolio) have slightly reduced its exposure to Crescent Capital BDC, reflecting a strategic decision in line with the firm’s investment philosophy. Although the weight of the company’s portfolio has decreased slightly due to the reduction of CCAP stock, it remains an important holding. This adjustment may indicate a rebalancing of a company’s portfolio or a response to market conditions or company performance.

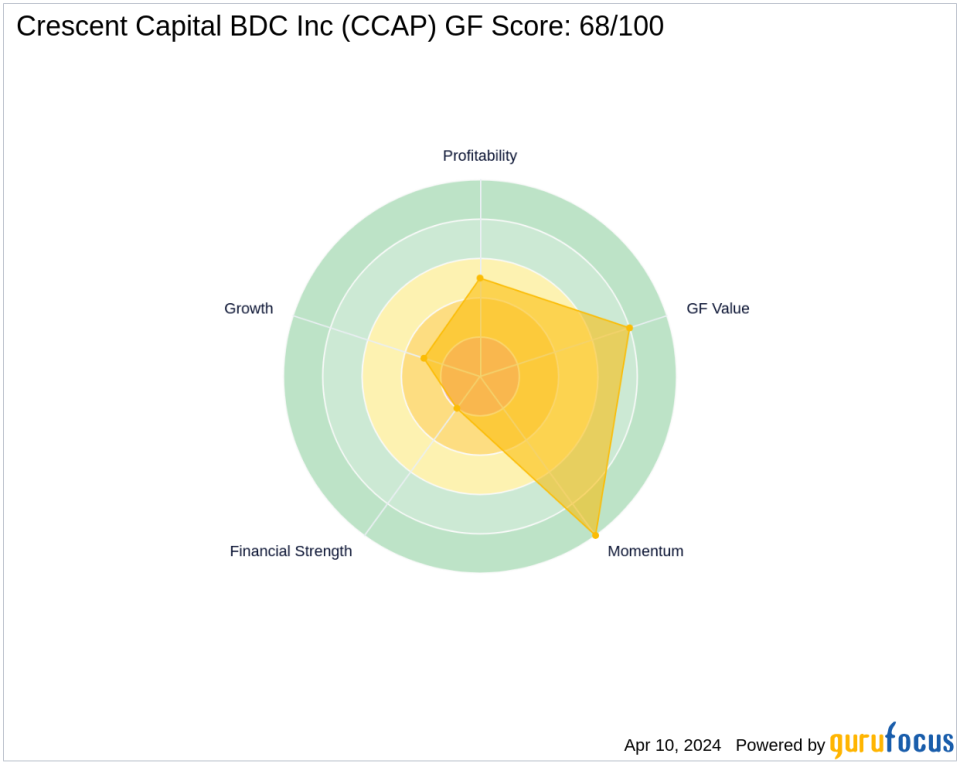

Financial health and market performance of Crescent Capital BDC Inc.

Crescent Capital BDC Inc.’s market capitalization is currently $630,054,000, and its stock price is hovering around $17.0002. The company has a price-to-earnings ratio (PE) of 7.39, suggesting it may be undervalued by the market. However, in his GF Value review, he classifies CCAP as a “possible value trap” and urges investors to think twice before investing. The price to GF value ratio is 0.57, which indicates that the stock is trading below its intrinsic value, according to GuruFocus’ proprietary methodology.

Sector and portfolio context

Prem Watsa’s (Trade, Portfolio) company has a diversified portfolio with strong inclinations to the technology and energy sectors. Within the asset management industry, Crescent Capital BDC Inc represents a unique investment opportunity due to its focus on middle market fixed income investments. The company’s strategic position in CCAP reflects its confidence in its business model and long-term profit potential.

Crescent Capital BDC Inc. performance and ranking

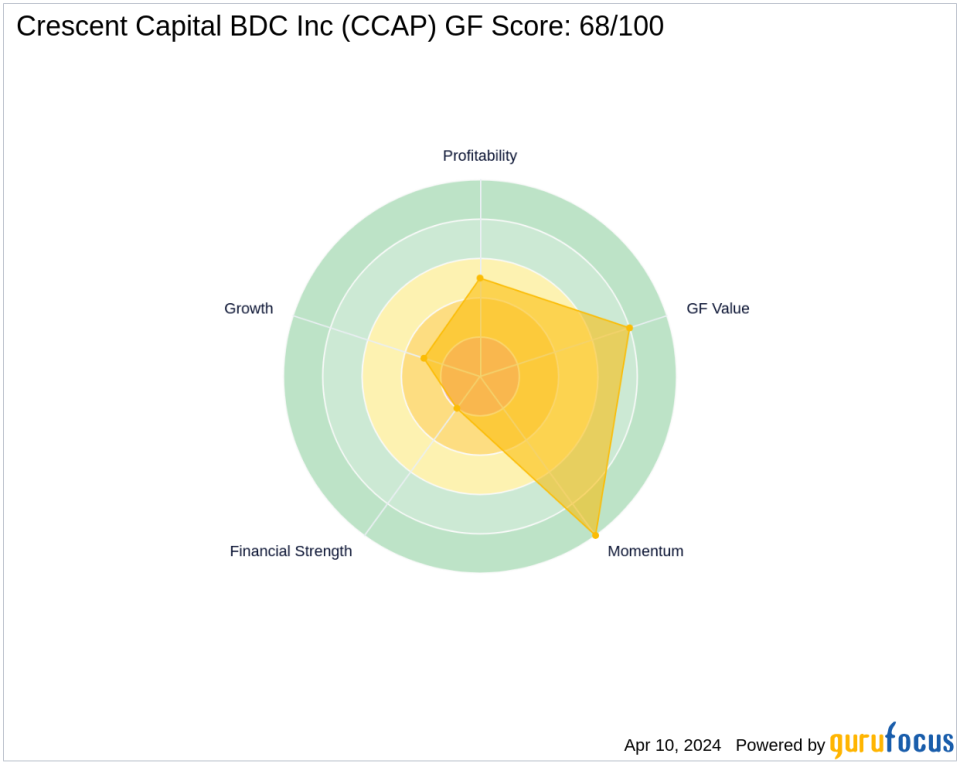

Crescent Capital BDC Inc’s GF Score is 68/100, indicating that its future performance is likely to be moderate. The company’s financial strength and profitability are a concern, ranking it 2/10 and 5/10 respectively. However, the GF Value Rank is 8/10, suggesting the stock may be undervalued. Momentum is strong for this stock, with a Momentum Rank of 10/10, which could indicate a positive trend in the short term.

Other notable investors in Crescent Capital BDC Inc.

The company of Prem Watsa (Trades, Portfolio) is not the only notable investor in Crescent Capital BDC Inc. Leon Cooperman (Trades, Portfolio) also serves in a position at the company, and we see CCAP attracting interest from several experienced investors. This collective trust can be a testament to the company’s potential and the strategic value it provides within the asset management sector.

transaction analysis

The recent writedown of Crescent Capital BDC Inc. stock by the firm of Prem Watsa (Trades, Portfolio) is a calculated move in line with the firm’s conservative investment approach. Although the transaction reduced the company’s CCAP stock slightly, it remains an important holding in the portfolio. This transaction reflects the firm’s continued portfolio management efforts and commitment to value investing principles. As the market continues to evolve, investors will be watching closely to see how this transaction impacts both stock price performance and the company’s future investment strategy.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.