From choosing the right team to lead your new venture to creating a cap table that will attract venture capital investors, here are some tips for successful venture building.

There is a resurgence of corporate interest in company creation. It is no longer enough for large corporations to invest in startups to foster innovation. More and more companies are looking to create their own startups as part of their overall venture toolkit.

According to Global Corporate Venturing’s latest annual Keystone survey of the corporate venture capital sector around the world, 37% of companies are venture building while taking minority stakes in start-ups.

For companies that have developed strong intellectual property, launching a venture based on that IP is a good option, Lina Arbelaez, head of decarbonization ventures at mining company Anglo American, said during a recent GCV webinar held in collaboration with law firm Fenwick & West.

“If you’re a fast-paced company developing a lot of exciting and potentially useful intellectual property, it may be advantageous to spin it out and monetize it rather than letting it sit on the shelf,” Arbelaez says..

“On the other hand, some have deep operational experience and have identified technology gaps and inefficiencies that need to be filled,” she says.

Despite its appeal, venture building has a reputation for being expensive and having a low success rate. There are few examples of companies that have done it successfully.

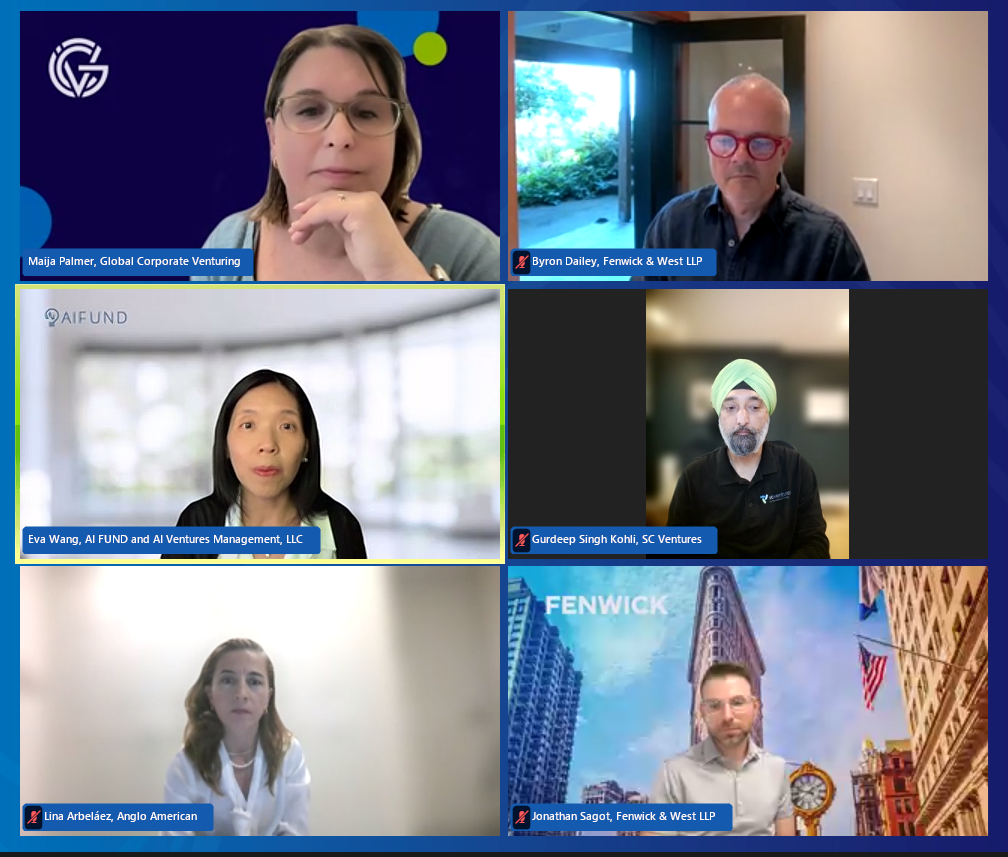

Participants in the webinar included venture incubation practitioner SC Ventures, the investment arm of UK-headquartered Standard Chartered Bank, US venture studio AI Fund, and legal experts from Fenwick & West.

Here are some tips they shared on how to do venture building well:

1. Decide whether you want to start your own venture or use an external venture studio

There are different ways to go about venture building. Some companies use external venture studios, others choose to build ventures in-house. Anglo American does both – they use external venture builders that look for company building opportunities, but they’ve also spun out some technologies in the mining space.

SC Ventures builds ventures in-house rather than using an external venture studio provider, and these ventures are set up as separate legal entities within the bank.

For companies wanting to launch a venture, it’s important to first consider which model to follow, says Jonathan Sagot, a partner at law firm Fenwick & West. “Understanding our client’s strategic goals allows us to select a structure that aligns with those goals and then help guide and deploy that structure effectively.”

Companies get into trouble when they’re not clear about which model to follow and haven’t fully thought through how they will hire and compensate employees. “Unless you’ve really thought through these issues and taken the time to talk to people who have lived through them, how are you going to know?” Sagot says.

2. The venture studio model

For companies that don’t have in-house company-building expertise, using a venture studio is a good option. AI Fund is one example of a US venture studio that partners with companies to launch artificial intelligence-based companies. A team of AI experts works with companies to understand how AI can solve the business problems they face. The venture studio then builds AI companies based on the solutions to these problems.

Companies typically invest in these startups in collaboration with venture studios, but there is flexibility if companies don’t want to put in the capital up front.

“Some companies may not have many resources to allocate to a particular project, so we can do most of the work and the company can decide whether to invest later,” says Eva Wang, partner and chief operating officer at AI Fund.

“Some companies prefer to be co-founders and get involved early and provide a lot of resources, sometimes assets. It’s up to each company’s preference,” Wang said.

3. Building an Intranet Venture

Other big companies have opted to set up ventures in-house. SC Ventures runs a venture incubation business alongside an investment arm that takes minority stakes in startups. The bank has created a holding company structure within the parent company to house the 15 ventures it has launched. Gurdeep Singh Kohli, head of SC Ventures, says it is important to have the right legal structure in place if you plan to set up ventures in-house.

“These are not internal projects,” Singh Kohli says of the ventures that have been launched internally. “They are set up as ventures from the beginning and are legal entities. These entities operate under different brand names and therefore have different governance and board structures,” he says.

4. Hire external talent or rely on in-house expertise

Many venture-building practitioners say the talent to lead new ventures should be hired from the outside. While companies have in-house experts in the field, only a select few can lead a company, and larger companies often don’t have those people. “We rely on studios to recruit,” says Anglo American’s Arbelaez. “It’s a really niche group that has the right background to be a founder. I don’t think there’s a lot of that talent within larger companies, or that’s been there for years.”

AI Fund spends a lot of time working to validate business ideas before hiring people to lead the company. After hiring founders, it does additional validation work before deciding to invest. “Before deciding whether to fund a company, it’s best to make a decision together with the company’s future co-leaders,” Wang says.

Some firms hire in-house for start-ups — SC Ventures is encouraging bankers with financial-services expertise to join the venture — and they also hire outsiders who bring commercial and technical expertise. “The key is to build a team with diverse thinking,” says Singh Kohli.

“I know a lot of examples of people who have no experience in a particular field who have been very successful by bringing in novel ideas. But as you mature, understanding how to operate in a regulated environment and how to operate in an institutional environment becomes really important to your success,” says Singh Kohli.

5. Develop a cap table

Finding the right way to share ownership of a new venture is key to attracting venture capital investment, and in the venture studio model, studios typically take a slightly higher stake than accelerators because they have to shape the company idea and then validate it, says Fenwick & West’s Sagot.

According to Sagot, venture studios typically receive 10% to 20% of common stock on a fully dilutable capitalization sheet. The studios typically set aside an equity incentive pool in the 10% to 20% range for future hires. The remaining equity, typically 60% to 80%, goes to the company’s co-founders. Venture studios should expect to receive more equity when investing in startups that are incubating. This could bring the venture studio’s ownership stake to around 40%.

“We see these as important guidelines for venture studios, as they have a bearing on a startup’s future ability to raise venture capital,” Sagot said, adding that it’s important that the venture studio’s equity remains lower than that of its co-founders. “Generally, this means that we direct venture studios to keep their overall equity holdings, both common and investment equity, to no more than 45%.”

For internally built ventures, the cap table can look quite different: If the parent invests significant amounts of money in the venture from pre-seed to scale-up, contributing to its success by bringing access to customers and establishing governance, “it’s fair to say the parent company or studio owns a majority stake in the venture,” says Singh Kohli.

The common presumption that founders should own a majority stake becomes less valid when companies are looking to attract strategic investors to their ventures. In the case of SC Ventures, which is looking for strategic venture capital for a banking startup, the emphasis on the founding team owning a majority stake is less important.

“If we were to bring in another bank, or a third firm, I don’t think they would point their finger and say no, but I’m investing in the founding team,” Singh Kohli said.

Watch the full webinar below:

This webinar is part of GCV’s The Next Wave series of webinars. We host webinars on the second Wednesday of every month, alternating between advice for CVC practitioners and deep dives into specific investment areas. Our next webinar is “Collaborating with Startups – CVC Platform or Venture Client?” Register here.