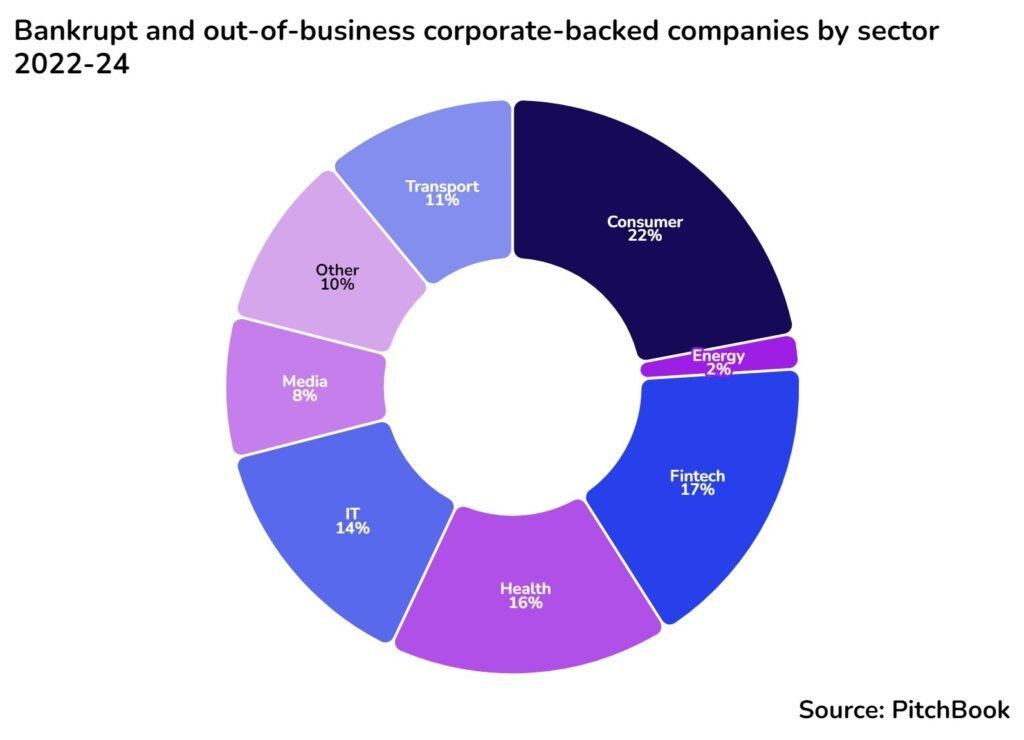

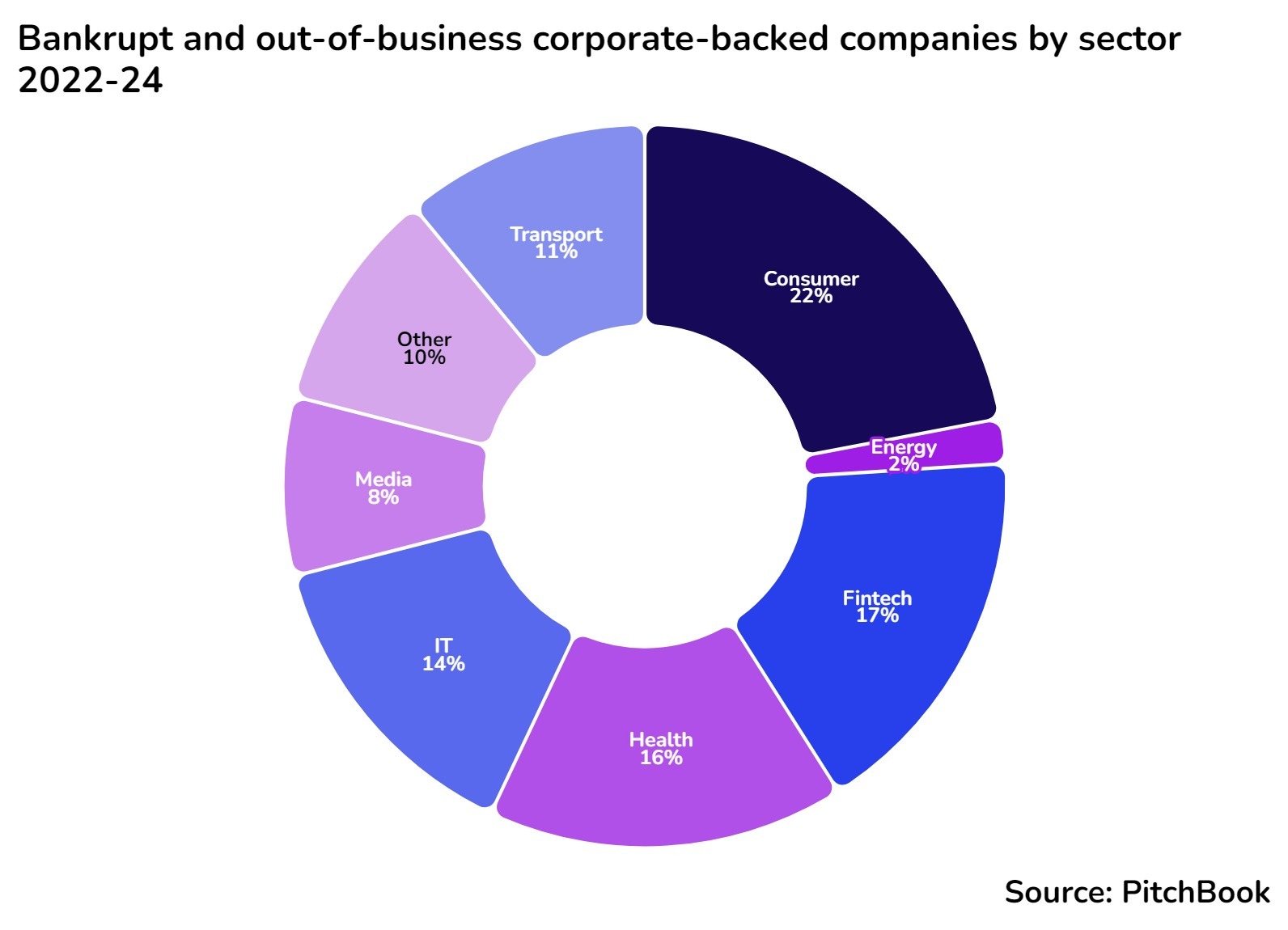

Alongside fintech and consumer startups, this sector is seeing the most startup failures in 2022 and beyond. Here are some of the reasons why:

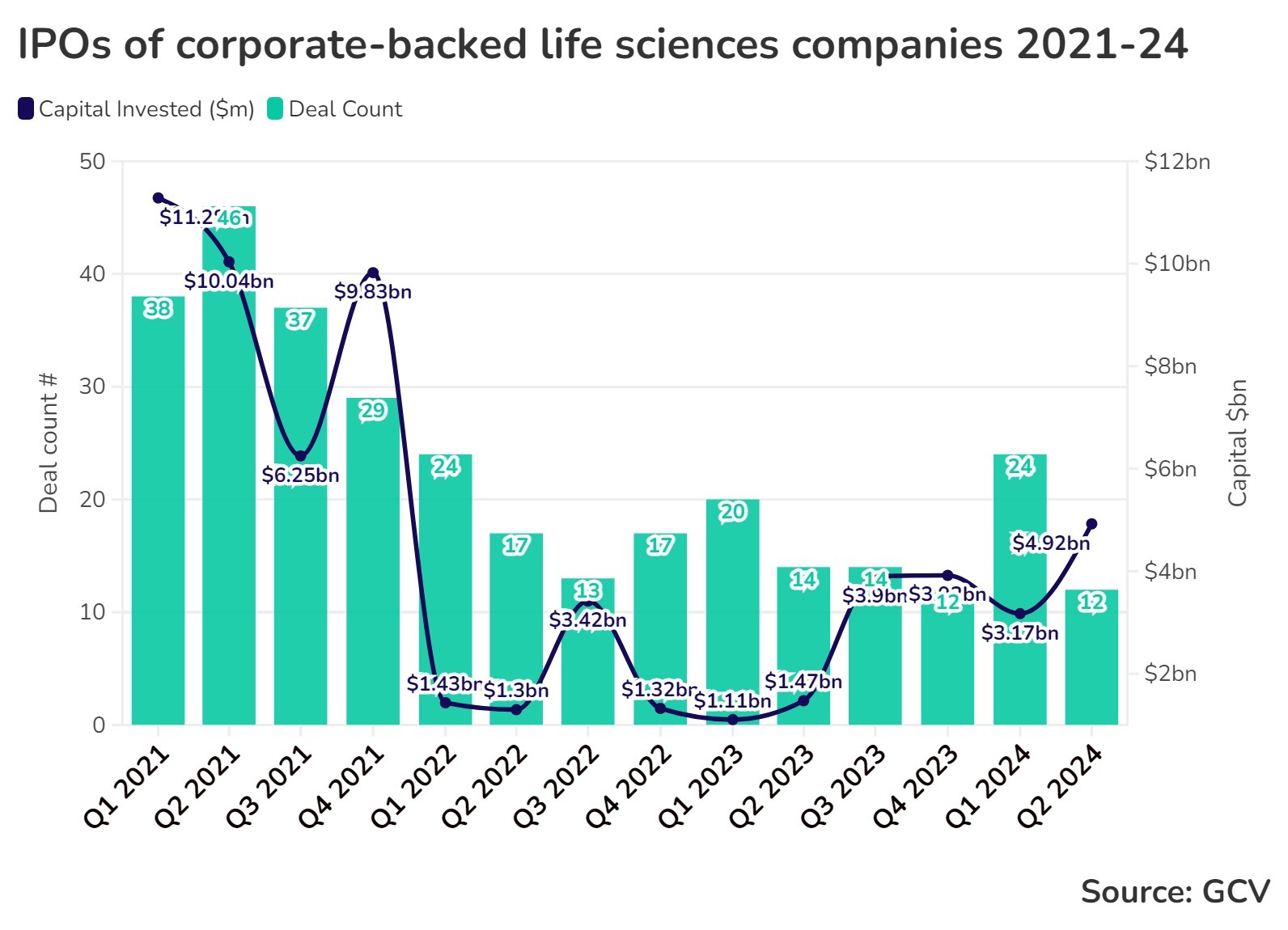

In life sciences, exits are on the rise, starting with CG Oncology’s $380 million IPO in early January, with more than 36 planned public offerings in the first half of 2024. While not back to the peak of 2021, when 150 IPOs raised more than $37 billion, activity has picked up recently.

At the same time, it is worth noting that corporate investors in the healthcare, life sciences and pharmaceutical sectors have been hit hard by company failures over the past two years: Alongside fintech and consumer startups, this sector has seen the most corporate-backed startup failures since 2022.

We found that in what we broadly call the healthcare sector, which includes life sciences and pharmaceuticals, there were around 19 corporate-backed startups that went bust. While corporate backing is often correlated with higher startup survival rates, it’s clear that not every portfolio company will be a winner.

Here are some of the reasons why these healthcare startups didn’t succeed:

1. Contest: Escape Bio

Escape Bio, a San Francisco-based developer of precision molecular therapies, emerged from bankruptcy by early 2023. The company had raised $167 million from high-profile corporate investors, including AbbVie Ventures, Johnson & Johnson Innovation JJDC, Lilly Asia Ventures, Novartis Venture Fund, and Novo Holdings, according to PitchBook. The company’s orally administered therapy was designed to treat genetically defined subgroups of neurodegenerative diseases, including Parkinson’s disease.

But the company was competing with Denali, a now publicly traded company that had secured $1 billion from Biogen for its Parkinson’s disease drug.

2. Excessive Debt: Tarveda Therapeutics

Tarveda Therapeutics, a Massachusetts-based solid tumor drug development company, was liquidated in April 2022. The company was developing a pentalin small drug conjugate for the treatment of patients with solid tumors. The small drug conjugate was intended to extend the lives of patients with hard-to-treat cancers and minimize potential toxicity. Tarveda had raised nearly $130 million in total before bankruptcy, according to PitchBook. The company reportedly had unmanageable debt, which led to liquidation. Backers included Massachusetts General Brigham Innovation, Novo Holdings, Cyclone Pharmaceuticals, and Tian Technologies Corporation.

3. Expansion trumps funding: Fluidic Analytics

It’s not entirely clear why Fluidic Analytics, a startup spun out of Cambridge University, closed in December 2023, but reading between the lines, it’s possible the company over-expanded and then failed to raise enough follow-on funding. The analytics tool developer had raised a total of $93 million from investors including Cambridge Enterprise, Innovate UK and Parkwalk Advisors.

The startup develops instruments for measuring protein-protein interactions in solution and believes it has 30-40 customers. US-based Fluidic Sciences acquired the technology in May 2024 and has also brought part of the scientific team into the company.

4. Legal Issues Regarding Licenses: VHsquared

VHsquared, a UK-based maker of a drug for the treatment of intestinal diseases, has raised more than $50 million from investors including SR One Capital Management, Takeda Ventures and Unilever Ventures.

Founded in 2010, the London-based company was working on developing new antibodies to target inflammatory bowel diseases such as Crohn’s disease.

However, the company became embroiled in a lengthy legal battle with biotechnology company Ablynx NV over the license to use immunoglobulins derived from camelids. Ablynx holds an exclusive license to the technology for medical uses, while VHSquared holds a license for food uses. The boundary between food and drug became an issue that the courts had to clarify.

As the litigation progressed, VHSquared reported significant losses and was unable to continue operating without further capital infusions. The company went into liquidation and ceased operations in January 2022.

5. Scam: Curonix (Stimwave)

In every group of companies, there’s at least one black sheep: US-based neurostimulation technology developer Curonix (formerly Stimwave), which was developing a tiny, injectable medical device that it said would offer a low-cost alternative to surgery.

However, founder and CEO Laura Tyler Perryman was convicted of manufacturing and selling counterfeit implants for patients, and the SEC also charged her with misleading investors by making false and misleading statements.

The company’s original investors included Asahi Kasei Corporate Venture Capital and Xandex Ventures.

Curonix filed for Chapter 11 bankruptcy protection in October 2022. According to PitchBook, the company received $40 million in debtor-in-possession financing from Kennedy Lewis Investment Management, which then acquired the company through an leveraged buyout.

Kaloyan Andonov

Kaloyan Andonov is Head of Analytics at Global Corporate Venturing.