As the once-hot southern market subsides, more affordable markets in the Midwest and Northeast gain popularity.

Is it possible that return-to-office policies are causing homebuyers to look for homes closer to their workplaces rather than in remote locations favored after the pandemic?

That’s certainly the conclusion Realtor.com reached in its February Hottest Housing Markets report. The report concludes, “Metropolitan hotness continues to rise as homebuyers return to the office and seek homes near business locations.” “These areas had about 11% more views per listing than the U.S. average in February, and homes spent 15% fewer days on the market than the U.S. median.”

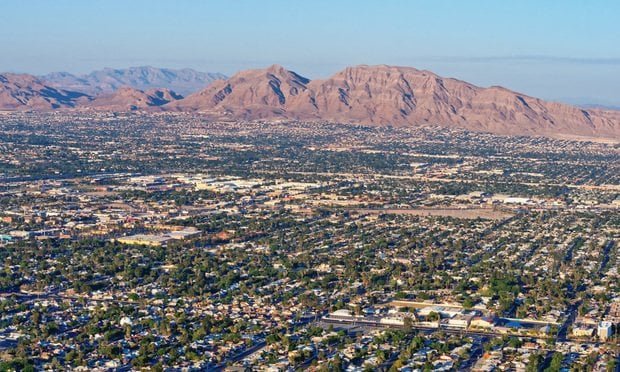

This trend particularly favored the western metros, which are home to four of the five markets that saw the greatest increase in favorability or “popularity.” They are Las Vegas-Henderson-Paradise, NV, Phoenix-Mesa-Scottsdale, AZ, San Bernardino-Riverside, ON, and Anaheim-Long Beach, CA. The fifth market was St. Louis, Missouri.

Realtor.com ranks market attention based on market demand, measured by unique views of each property, and market pace, measured by the number of days a property remains active. Annual home prices rose 3.8% in the nation’s hottest markets in February, compared to just 0.3% nationally.

However, price increases have been slower than since August 2021, “suggesting that the slowdown in price increases is also impacting the markets with the highest demand.”

Meanwhile, typical homes for sale in these markets were down slightly compared to a year ago. As a result, median price per square foot rose 5.5% annually in February. New Hampshire’s Manchester-Nashua region is once again the hottest region in the United States, approaching that status for the first time in March 2021. But four other “hot” markets saw prices decline but remained in the top 20: Oshkosh-Neenah, Wisconsin; Dayton-Kettering, Ohio; Lancaster, Pennsylvania; and Bridgeport-Stamford, Connecticut. In his first three regions, prices per SF have increased, suggesting smaller, less expensive homes are on the market. However, Bridgeport-Stanford saw his price per SF drop by 6.9%.

Three markets were removed from the top 20 list: Norwich-New London, Conn., Rockford, Ill., and New Haven, Conn. But it remains within striking distance, “underscoring the recent popularity of the Midwest and Northeast metros, which have dominated the list since February 2022.” In contrast, many metros in southern states suffered even more sharply from rising prices and mortgage rates. The three cities in Florida most affected were Punta Gorda, North Port/Sarasota/Bradenton, and Cape Coral/Fort Myers.

“As the once-hot Southern markets subsided, the more affordable markets of the Midwest and Northeast grew in popularity,” the report said. “Decreased demand has allowed inventory levels to recover in these markets and price increases to smolder, suggesting further market balance.”

Spring in apartment complexes:

Multifamily Spring will be held in New York City this April 18th. This year’s program brings together the industry’s most influential and knowledgeable multifamily real estate executives for 5 hours of in-person networking and over 5.5 hours of can’t-miss events. session. Learn more or register here.